Welcome back to False Flag! I hope you’re not a diehard “diamond hands” holder of Steve Bannon’s memecoin, because this week we’ve got some bad news on that front. But look on the bright side: If you haven’t blown a five-figure investment on MAGA memecoins, you may now have enough in reserve to sign up for Bulwark+! Doing so would help support this newsletter and everything else The Bulwark offers. Upgrade today for 20 percent off the normal price and your membership will carry you through Election Day 2026 and well into next year. Note: This special offer on annual subscriptions ends tomorrow. –Will Steve Bannon Is in Trouble—and It Has Nothing to Do With Epstein“Worse than I ever imagined”: lawsuit reveals the podcaster’s memecoin woes.PERPETUAL TRUMPWORLD FIGURE Steve Bannon is taking a lot of heat this month as newly released Jeffrey Epstein files show he maintained close ties with the notorious sex trafficker, even after many of Epstein’s worst crimes were exposed. But that’s not the only perilous legal matter on Bannon’s plate. The influential conservative podcaster also finds himself in hot water for his management of the disastrous “Fuck Joe Biden” cryptocurrency. On Thursday, aggrieved Missouri-based investor Andrew Barr filed a lawsuit against Bannon, fellow MAGA bigwig Boris Epshteyn, and others involved in the operation of the “FJB” coin, alleging that he had lost $58,730.98 on the venture. The lawsuit, which is awaiting certification by a judge to become a class-action case, offers a tantalizing look at the Wild West that is the cryptocurrency industry. It’s the type of stuff that would normally pique the interest of regulators, if not for the fact that the White House has shown a general indifference to regulating this market—and that the Trump family has its own failed memecoins to deal with. Bannon didn’t respond to a request for comment. And Epshteyn couldn’t be reached for comment. Problems with the now-defunct “FJB” coin are familiar to cryptocurrency critics. It came with an unusually high 8 percent fee on transactions, with the commitment that it would be divided between 3 percent coin management and promotion and 5 percent going to charitable donations. But after Bannon and Epshteyn purchased ownership of the FJB coin business in December 2021, the coin’s operators could only produce proof of small charitable donations, angering buyers who had thought their money would go to causes like veterans’ care. Since cryptocurrency wallets are public, the problems became evident fairly quickly. One crypto expert told ABC News in 2023 that some of the money earmarked for “charity” was instead being directed to a wallet that appeared to use the money on “high-risk investments in obscure coins.” But Barr’s lawsuit offers more details into how “FJB”—whose acronym was re-spelled as “Freedom Jobs Business” under Bannon and Epshteyn’s ownership—sank into oblivion. Early on, Bannon and Epshteyn billed “FJB” as the basis of an entirely new “uncancelable” MAGA economy. The coin was promoted by other MAGA figures like Jack Posobiec and Benny Johnson. But according to the lawsuit, Bannon and Epshteyn ran it straight into the ground. Amid a broader decline in memecoins values in 2023, the price of “FJB” price plummeted and both Bannon and Epshteyn distanced themselves from the project. The lawsuit alleges that $2.7 million in transaction fees meant for charity or efforts to promote the coin instead disappeared entirely. In one direct-message exchange on the Discord platform that is included as an exhibit in the lawsuit, top coin administrator Sarah Abdul and programmer Chase Bailey offered their lament over an alleged $120,000 payment from FJB to Epshteyn’s friends for lackluster services. But, they concluded, it was “drops in the bucket” compared to more serious financial mismanagement, which they didn’t spell out. Abdul told Bailey the management of the coin’s money was “worse than I ever imagined,” according to the lawsuit. “This looks sooooo neglegent [sic],” Bailey replied.¹ Investors also fumed as Bannon started to mention the coin less on his podcast, depriving it of the publicity critical to elevating its otherwise very limited value. As that value imploded, FJB operators attempted to rebrand the coin as “Patriot Pay.” But that effort stumbled when Bannon and Epshteyn failed to secure the Patriot Pay trademark because the name was already taken, according to the lawsuit. In February 2025, according to the lawsuit, the coin’s bedraggled investors were further stunned when their wallets were locked, making it impossible to convert their coin to another currency. The lawsuit claims that the money is still stuck inside the coin, with payments frozen and no word from the coin’s administrators in a year. FJB no longer exists as a traded coin, making it impossible to know what its remaining value could be. How much promise it ever really possessed is impossible to divine, though it seems quite limited, since it was trading at roughly $0.0015 when Bannon and Epshteyn purchased it. FJB IS NOT THE FIRST CASE STUDY in why it might not be wise to invest in a Bannon-led venture. The investment-banker-cum-political-operative-cum-podcaster was indicted in 2020 for his role in the fraudulent “We Build the Wall” effort to crowdfund the construction of a southern border wall. He avoided prosecution only after Trump pardoned him. And then, last February, Bannon pleaded guilty to felony “scheme to defraud” in a state-level case arising from the wall fundraising. Separately, Bannon spent four months in federal prison in 2024 for contempt of Congress.² Still, Bannon’s a survivor. If those convictions, the Epstein revelations, and this lawsuit don’t scare off future investors, I’m sure we’ll be back again soon talking about Bannon’s latest venture—and potentially, the investors or donors who feel burned by it. 1 In a treat for fans of I Think You Should Leave comedian Tim Robinson, one of the coin’s lead organizers used the Discord alias “Sammy Paradise.” That’s a reference to a comedy sketch where Robinson, playing an unflappable Rat Pack–style gambler of that name, loses his cool after he blows through all his money. Foreshadowing? 2 Bannon’s most notorious co-defendant, triple-amputee veteran and We Build the Wall frontman Brian Kolfage, is set to be released from federal prison in March, according to the Bureau of Prisons. You’re a free subscriber to The Bulwark—the largest pro-democracy news and analysis bundle on Substack. For unfettered access to all our newsletters and to access ad-free and member-only shows, become a paying subscriber.We’re going to send you a lot of content—newsletters and alerts for shows so you can read and watch on your schedule. Don’t care for so much email? You can update your personal email preferences as often as you like. To update the list of newsletters or alerts you received from The Bulwark, click here. Having trouble with something related to your account? Check out our constantly-updated FAQ, which likely has an answer for you. |

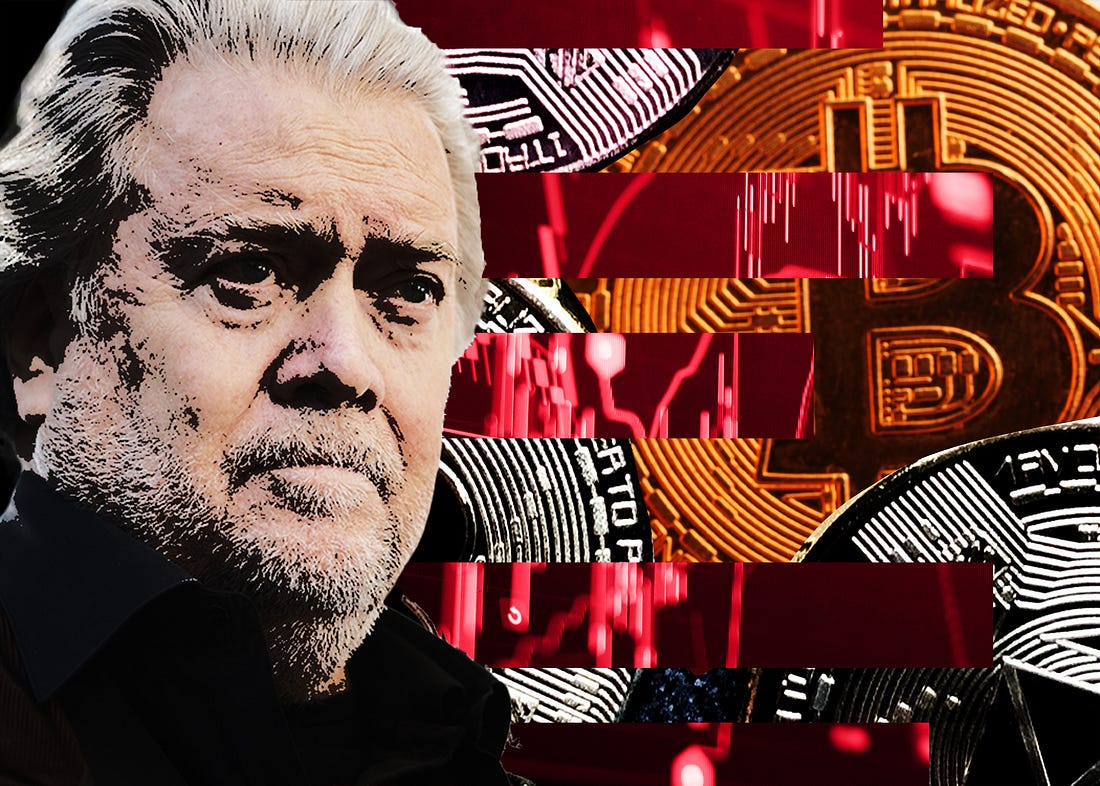

Steve Bannon Is in Trouble—and It Has Nothing to Do With Epstein

February 16, 2026

0